Fortify Your Finances with Chase Multi-Factor Authentication (MFA)

Protecting your Chase account requires more than just a strong password. Multi-factor authentication (MFA) adds an extra layer of security, acting like a virtual security guard constantly watching over your finances. Think of it as adding a high-tech lock to your online banking door, making unauthorized access significantly harder. This guide provides a step-by-step walkthrough to setting up and utilizing Chase's MFA, enhancing your financial security.

Understanding Chase's Enhanced Security Measures

MFA works by requiring more than just your password to access your account. It adds a second (or even third) verification step, making it exponentially more difficult for unauthorized individuals to gain access, even if they somehow obtain your password. This extra layer significantly reduces your risk of fraud and identity theft.

Chase MFA uses a variety of verification methods, including:

- One-Time Codes (OTCs): These temporary codes are sent via text message (SMS) to your registered phone number or generated by an authenticator app (like Google Authenticator or Authy).

- Biometric Authentication: If your device supports it, you might be able to use fingerprint or facial recognition for a quick and secure login.

The strength of Chase's MFA lies in its adaptability, constantly evolving to stay ahead of emerging threats.

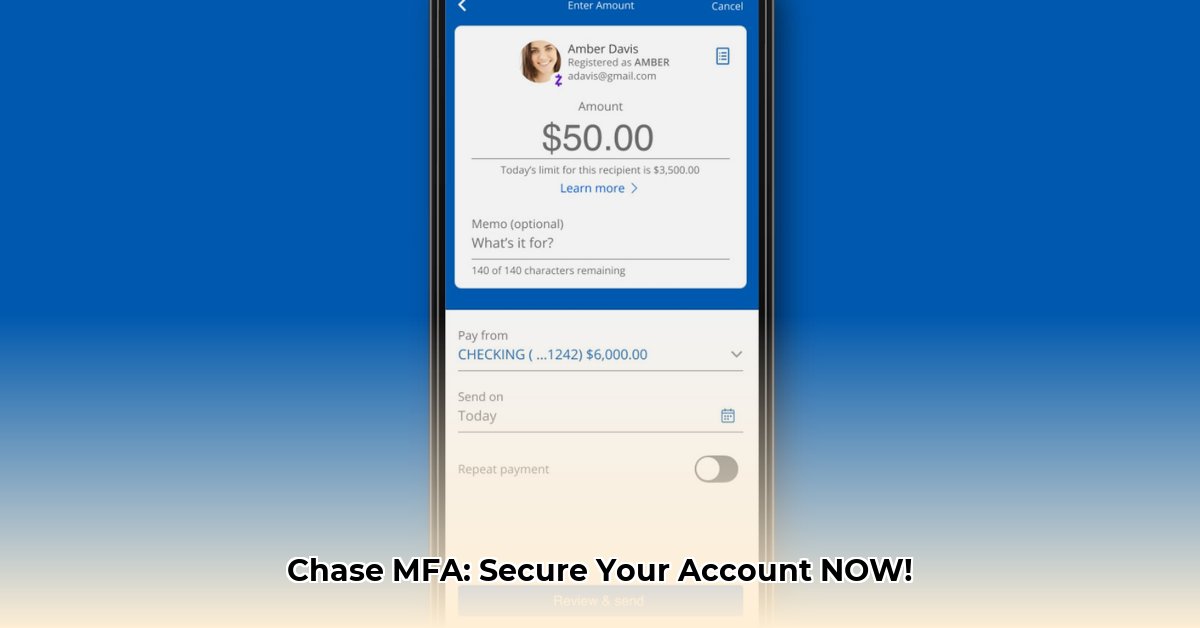

Setting Up Chase Multi-Factor Authentication: A Simple Guide

Ready to bolster your account's security? Follow these easy steps:

Log In: Access your Chase online account or mobile app as usual.

Locate Security Settings: Find the "Security," "Settings," or similar section within your account. The exact location may vary slightly depending on the platform (website or app).

Enable MFA: Select the option to enable multi-factor authentication. Choose your preferred verification method (SMS, authenticator app, or biometric authentication, if available).

Follow On-Screen Instructions: Chase will guide you through the setup process, which might include verifying your phone number or downloading and configuring an authenticator app.

Test Your Setup: After completing the setup, log out and then log back in to confirm everything is working correctly. This simple test provides immediate peace of mind.

Choosing the Best MFA Method for Your Needs

Chase likely offers several MFA options. Consider these factors when making your selection:

| Method | Advantages | Disadvantages |

|---|---|---|

| Text Message (SMS) | Simple, readily available on most phones | Vulnerable to SIM swapping (a serious security risk) |

| Authenticator App | More secure than SMS, less susceptible to SIM swapping | Requires app download and setup |

| Biometrics (if available) | Convenient, fast authentication | Device-dependent; security relies on device security |

Using multiple MFA methods simultaneously (e.g., both an authenticator app and SMS codes) provides superior protection.

Additional Tips for Enhanced Account Security

While MFA is crucial, it's just one part of a comprehensive security strategy. Consider these additional steps:

Strong Passwords: Use unique, complex passwords for all your online accounts. Avoid reusing passwords across different platforms. Consider a password manager to simplify this process.

Regular Account Monitoring: Review your account statements and transactions frequently for any unauthorized activity. Early detection is paramount.

Phishing Awareness: Be wary of suspicious emails or texts requesting personal information. Chase will never ask for login credentials via email.

Software Updates: Keep your software, apps, and operating system up-to-date with the latest security patches. Outdated software is a prime target for hackers.

By combining Chase MFA with these proactive security measures, you significantly reduce your vulnerability to online fraud and protect your hard-earned money. Remember, vigilance and education are your best defenses.

Preventing Chase Account Fraud: A Proactive Approach

Key Takeaways:

- While MFA significantly improves security, it's not an absolute guarantee against all attacks.

- Combining various security measures creates a more robust defense.

- Staying informed and adapting to evolving threats is essential.

- User awareness and vigilance play a critical role in preventing fraud.

Dr. Anya Sharma, Cybersecurity Expert at [Institution Name], emphasizes the importance of proactive security measures: "Multi-layered security is key. Relying solely on a single method, even MFA, leaves you vulnerable. A combination of strong passwords, MFA, and vigilant monitoring is your best defense."

⭐⭐⭐⭐☆ (4.8)

Download via Link 1

Download via Link 2

Last updated: Friday, May 23, 2025